Students of finance might have come across the term Efficient Market Hypothesis (EMH). Followers of this philosophy believe that the market is a reflection of all available information (about its constituents) that an investor would need in order to invest. This would mean that the market is always “fairly priced”.

Fans of Star Trek must surely remember the “Borg”, the collection of organic cum synthetic matter into a single entity of collective consciousness. This consciousness does not manifest as something on its own, rather it represents that of the sum of the “ecosystem” of individual “drones” (as the individual entities linked together in the collection are called).

Proponents of EMH believe that like the Borg (characterization mine!) the market is but a collection of all the thinking and actions of its constituents – millions of individual and institutional investors, traders and speculators. They believe that one cannot “outwit” the market since all the information one needs in order to value a security is already available and that the price of the security reflects this information. Market behaviour too is a reflection of the behaviour of individual and institutional players in the market. An interesting offshoot of this is evident in times of extreme exuberance or fear when market participants, either buy like crazy or dump their shares, which further causes panic buying or selling respectively causing a vicious cycle.

Now what is the trigger that causes this wave? It can be an irrational fear or a rumor, a real disastrous event like the Covid Pandemic, an act of terrorism like the Nov 26, 2008 attack in Mumbai, etc. It is not so much that the event happened that caused the panic in most cases, rather, the constant frothing at the mouths and hyperactive pontifications by media and so-called pundits, which provide fuel to the fire that rages through the minds of millions of investors. This trigger can also be caused by unfounded rumors started by unscrupulous speculators who want to profit from the mass hysteria. A real example is the numerous “Pump and Dump” schemes still prevalent in the market today.

On the other hand, market exuberance can also be triggered by rumors or legitimate reasons. Events like better than expected interest rate cut by central bank, business friendly policy initiative, benefits to individuals like Income Tax rate cuts, etc can excite investors into believing that the “market will rise” whereas in reality, it is their buying of stocks that causes the market to rise. Efficient Market Hypothesis proposes that the market does not have a mind of its own, rather its “mind” is the collection of all market participants.

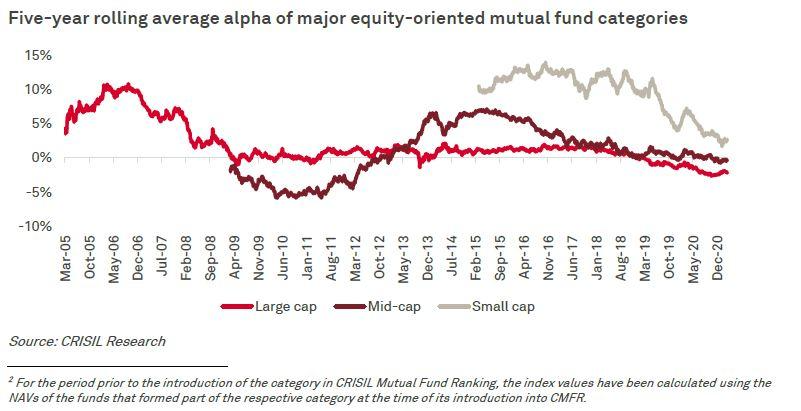

The proponents of Efficient Market Hypothesis believe that the market cannot be beaten and that it is outrageous to pay enormous sums of monies to active fund managers who claim to possess the skills to beat the market. And in fact, much of this belief has been proven right by studies which compare total returns of a passively held portfolio versus an actively managed portfolio.

As you can see, except for small cap equity funds both Large Cap and Mid Cap actively managed equity mutual funds over the long term have underperformed the index.

So does this mean that every bit of information is already known to investors, or is the market truly efficient? Does this mean there is no way to exploit inefficiencies in information available to investors and create opportunities? This may be true in the long term, over many business and market cycles. However, there is still that out performance or alpha to be had in actively managing portfolios at least in the short and medium term where we can obtain superior information by applying one of the many research and investing strategies prevalent in the industry. Different business cycles throw up different sets of winners and funds which are able to identify and act on opportunities to make money.

Even among such active managers there exist multiple strategies for investing – Fundamental, Quantitative, Technical Analysis, or a combination of the three. Even among them there exists multiple types of styles such as Value, Growth, or a combination of the two, Market Capitalization based portfolios, Sector specific, Event driven investment strategies and so on. Each of the above mentioned Active strategies do work in a limited timeframe and business environment.

However, it is very difficult to consistently squeeze out that competitive edge in investing using active management for the long term. Ultimately, any alpha (or excess return) is tempered by Transaction Costs, Management Overheads, Taxes, etc. It seems the verdict is in favor of Index or Passive Management, which is a manifestation of the Efficient Market Hypothesis, when time frame being considered is long term.